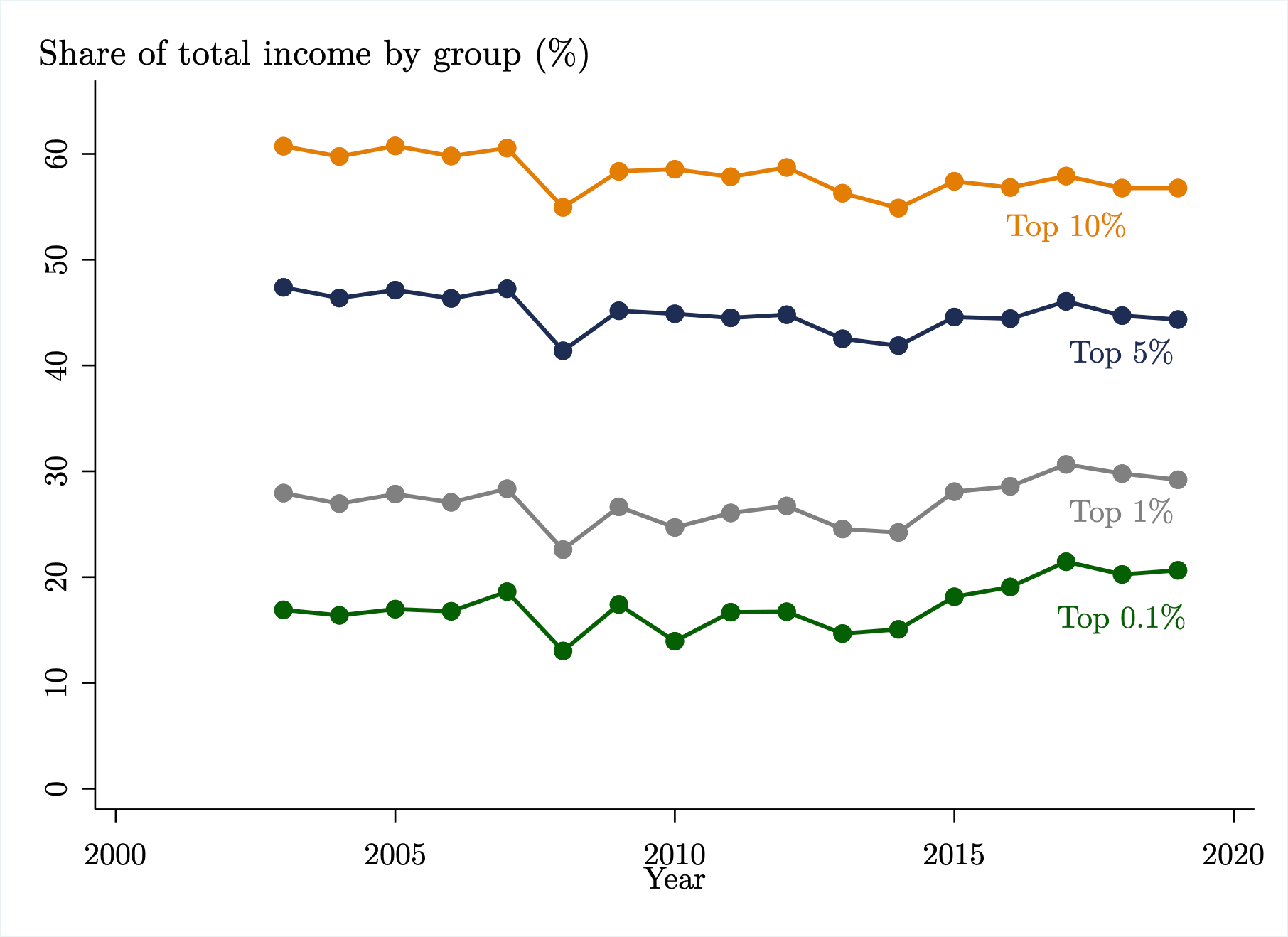

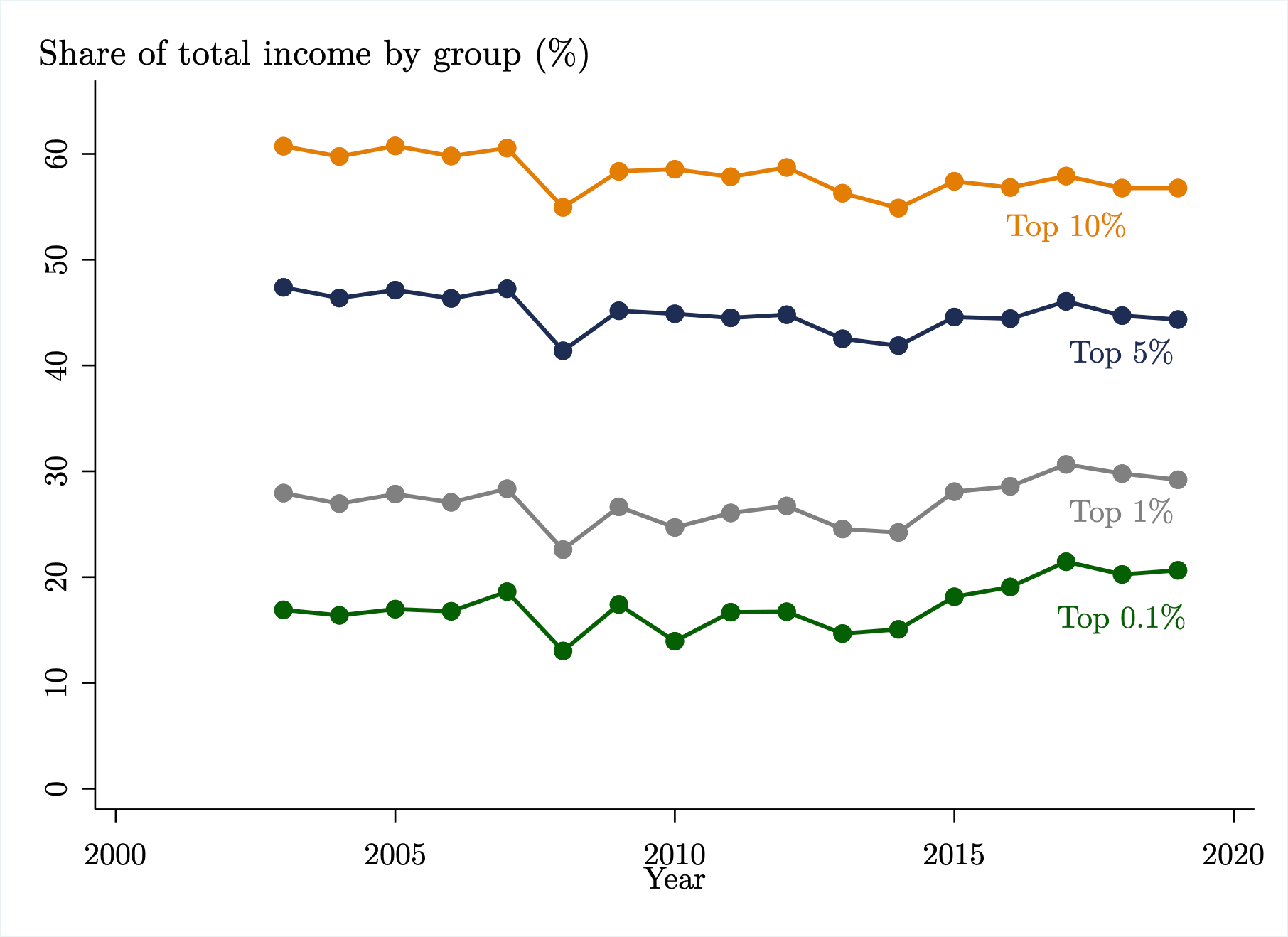

Two Decades of Top Income Shares in Honduras

Journal of Public Economics 2025, Volume 246

Co-authors: Giselle Del Carmen, Santiago Garriga, and Wilman Nuñez

Two Decades of Top Income Shares in Honduras

Journal of Public Economics 2025, Volume 246

Co-authors: Giselle Del Carmen, Santiago Garriga, and Wilman Nuñez

Corporate Taxation and Evasion Responses: Evidence from a Minimum Tax in Honduras

American Economic Journal: Economic Policy 2024, 16(1): 482-517

Co-authors: Felipe Lobel and Pedro Zuniga

Coverage:

Selecting Top Bureaucrats: Admission Exams and Performance in Brazil

The Review of Economics and Statistics 2025 (2): 408-425

Co-authors: Laura Schiavon and Ricardo Dahis

Coverage:

The Importance of Political Selection for Bureaucratic Effectiveness

Economica 2023; 90(359): 746-779

Co-authors: James Habyarimana and Stuti Khemani

Tax Progressivity and Inequality in Brazil: Evidence from Integrated Administrative Data

Co-authors: Theo Palomo, Davi Bhering, Pierre Bachas, Luciana Barcarolo, Celso Campos, Javier Feinmann, Leonardo Moreira and Gabriel Zucman

Abstract

We use population-wide administrative micro-data to provide new estimates of income inequality and effective tax rates by income groups in Brazil, capturing all income and all tax payments. Our data allow us to link businesses to their owners and thus to allocate business income and associated taxes to the corresponding individual firm owners. We provide sharp upward revisions to official inequality estimates: the top 1% earns 27.4% of total income in 2019, one of the highest level recorded in the world. The tax system, which relies heavily on consumption taxes, is regressive: while the average tax rate in the economy is 42.5%, this rate falls to 20.6% for million-dollar earners (roughly the top 0.01% of the distribution), due to the non-taxation of dividends and provisions that reduce corporate tax liabilities. We provide evidence suggesting that inequality in developing countries may be systematically underestimated, as even in Brazil—where dividends are untaxed, and hence incentives to retain income within companies are limited—attributing profits to business owners substantially raises income inequality

MiDES: New Data and Facts from Local Procurement and Budget Execution in Brazil R&R at World Bank Economic Review

Co-authors: Ricardo Dahis, Lucas Nascimento, Bernardo Ricca and Nathalia Sales

Abstract

This paper introduces a new disaggregated and harmonized dataset on public procurement and budget execution by Brazilian subnational entities, which currently covers half of Brazilian municipalities and spans the years 2003–21. This dataset provides key information that was previously unavailable from aggregate data, such as the identities of suppliers, details on purchases of goods and services, and granular information on the life cycle of each expenditure action. It then uses these data to provide new stylized facts about local public finance. First, it shows that about one-quarter of government purchases are locally procured and discusses implications for efficiency. Second, it demonstrates that close to 15 percent of payments exceed the 30-day threshold and that payment timeliness is systematically correlated with the income level of the municipality.

The Elusive Impact of Corporate Tax Incentives

Co-authors: Massimiliano Cali and Giorgio Presidente

Abstract

Despite the large fiscal footprint of corporate tax incentives, limited causal evidence exists on their impact on economic outcomes. This paper helps fill this gap by exploiting the phasing out of a large income tax exemption scheme for export-oriented firms in Tunisia. Using data on the universe of registered Tunisian firms, the analysis shows that the reform caused a decline in the entry of new firms in the sector previously benefiting from the incentives. However, the reduced entry did not translate into any effects on employment, revenue, or the wage bill, as the reform did not impact the activities of incumbent firms, which account for the bulk of economic activity in Tunisia. The findings are robust to addressing various threats to the empirical identification, and they confirm emerging evidence casting doubt on the importance of tax incentives to determine investments relative to other factors in an economy.

Exploring the Gender Divide in Real Estate Ownership and Property Tax Compliance

Co-authors: Tatiana Flores, Guillermo Cruces, Jose Carlo Bermúdez, Juan Luis Schiavoni and Dario Tortarolo

Abstract

This paper investigates gender disparities in residential property ownership and tax compliance in a large Argentine municipality using detailed tax administrative data. While ownership is evenly distributed between women, men, and co-owned properties up to the 40th percentile of the value distribution, higher-value properties exhibit significant gender disparities, with women's share dropping to less than 20% in the top 1%. Tax compliance increases with property value, with an average evasion rate of 46%, and men and women are equally likely to meet their tax obligations across the distribution. However, women face slightly higher effective tax rates due to owning lower-value properties, which are disproportionately affected by a mildly regressive tax schedule. Gender responses to enforcement measures are also comparable. A soft randomized communication campaign significantly increased timely payments equally for both men and women, with men responding more quickly. Similarly, the findings show no gender-based differences in responses to macroeconomic shocks such as COVID-19. The study underscores the role of property tax in promoting equitable revenue mobilization and highlights the importance of gender-disaggregated data for informing tax policy and enforcement strategies.

VAT Refunds and Firms' Performance: Evidence from a Withholding Reform in Honduras

Co-authors: David Pinto and Jose Carlo Bermúdez

Abstract

Late or unreliable refunds of credits undermine the best traits of value-added tax (VAT) systems and might affect firms' growth and investment opportunities. This paper uses administrative tax records in Honduras to study a tax reform that decreased the withholding rate of value-added tax liabilities by credit and debit card (DCC) providers, aiming to curb unrefunded credits. Using a difference-in-differences approach, exploiting differential exposure to the reform, the paper documents that it caused a decrease in excessive withholding and was equivalent to a cut of 1.1 percentage points in effective tax rates faced by treated firms. The paper then evaluates the effects on firms' economic performance and estimate 0 effects on several indicators of economic growth and investment. The results challenge the premise that unrefunded VAT credits are an important constraint to firm growth in certain settings.

Trade-offs in the Design of Simplified Tax Regimes: Evidence from Sub-Saharan Africa

Co-authors: Christopher Hoy, Alex Oguso, Anna Custers, Daniel Zalo, Ruggero Doino, Jonathan Karver and Nicolas Pillai

Abstract

This paper provides novel evidence of the trade-offs policy makers face when designing simplified tax regimes for small businesses. First, it provides a comprehensive stocktaking of the main features of these regimes across Sub-Saharan Africa: they are adopted by two-thirds of countries, but their design varies greatly. Second, it draws on administrative and survey data for a thorough examination of a specific simplified tax regime. This analysis shows most small businesses lack knowledge about design features, such as the existence of a minimum exemption threshold, but they react strongly to increases in tax rates by lowering their declared turnover. Finally, the paper presents the results of an experiment that encourages taxpayers to pay fixed amounts—a potential alternative design of a simplified tax regime that aims for a better balance of the trade-offs facing policy makers. The findings show that providing simple guidance about how much small businesses with similar characteristics typically pay in taxes can increase revenue, but this reduces equity among taxpayers.

Speed of Payment in Procurement Contracts: The Role of Political Connections

Co-authors: Ricardo Dahis and Bernardo Ricca

Abstract

We provide evidence of a new channel through which politicians can exchange favors with campaign donors: earlier payment in procurement contracts. We exploit an electoral reform in Brazil that bans corporate contributions and partially breaks down the relationship between donors and politicians. Using a within-firm difference-in-differences identification strategy, we find that connected firms experience longer payment terms post-reform. The effect is larger in municipalities with low liquidity, where payment delays are more common, and for contracts awarded through a competitive tendering process. Our results point to the importance of designing rules that curb discretion over the contract execution process in government purchases.

Corporate Responses to Size-Based Tax Rates in Lithuania

Co-authors: Pablo Garriga

Abstract

This paper studies how firms respond to differential, size-based tax rates using administrative tax data in Lithuania. Exploiting a notch in the tax schedule faced by corporations, it documents strong behavioral responses to tax incentives—revenue elasticity is estimated at 0.35 and cost elasticity at −1.3, implying a large total profit elasticity of 7.4. It then leverages the panel structure of the data to provide insights on the dynamic effects of these tax incentives. Firms located close to but below the notch report systematically lower revenue growth in the short term, but the effects dissipate over time.

Building State Capacity: What is the Impact of Development Projects?

Co-authors: Vincenzo Di Maro, David Evans and Stuti Khemani

Abstract

Although research has established the importance of state capacity in economic development, less is known about how state capacity comes about and the role of external partners in the process. This paper estimates the impact of an external project designed to build state capacity in a low-income country. Specifically, it evaluates a multilateral development bank project in Tanzania, designed to incentivize investments in local state capacity by offering grants conditional on institutional performance scores. This program typifies many development projects to build state capacity implemented around the world by development agencies. The paper uses a difference-in-differences methodology to estimate the project impact, comparing outcomes between 18 project and 22 non-project local governments over 2016–18. Outcomes were measured through two rounds of primary surveys of nearly 500 local government officials and nearly 3,000 households. Over the course of the project, measured state capacity improved in project areas, but due to comparable gains in non-project areas, the project's value-added to change in state capacity is estimated to be zero across all the dozens of relevant variables in the surveys. The data suggest that improvements in state capacity in Tanzania resulted from endogenous changes in trust and legitimacy in the country rather than from financial incentives offered by external partners.

Targeting in Tax Compliance Interventions: Experimental Evidence from Honduras

Co-authors: Giselle del Carmen and Edgardo Enrique Espinal Hernandez

Abstract

Tax authorities often use low-cost communication with taxpayers to encourage voluntary compliance and avoid other costly interventions. This paper reports findings from an experiment with more than 30,000 taxpayers in Honduras, designed to assess how taxpayers with different risk scores respond to a communication intervention. Across several outcomes, the average effect of the intervention on compliance was zero. Contrary to the expectation of experts surveyed, only taxpayers considered to be at low risk of noncompliance increase their filing and reported income. Using rich administrative data and a causal forest algorithm, the paper finds that ex-ante predicted risk and responsiveness to the intervention are negatively correlated. These findings can inform the design of targeted interventions by tax authorities.

The Financial Risk of Winning a Procurement Contract: Evidence from Chile

"Sifting through the Data: Labor Markets in Haiti through a Turbulent Decade (2001-2012)"

"But ... what is the poverty rate today? Testing poverty nowcasting methods in Latin America and the Caribbean"

"Cyclical Variations in Participation and Employment in Urban Brazil"

"Investing in people to fight poverty in Haiti: reflections for evidence-based policy making (Haiti Poverty Assessment)"